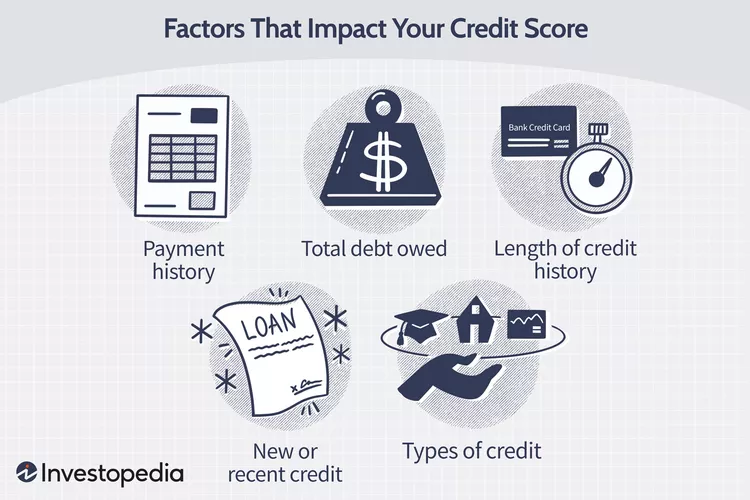

By focusing on localized data and industry-specific trends, we ensure that our customers receive the most accurate and relevant credit solutions to make informed decisions, manage risks, and drive sustainable growth.

We gather and process vast amounts of financial and behavioral data, allowing for deeper analysis and more accurate credit assessments.