- Personal Credit Score

- Personal Credit Report

- Identity Verification

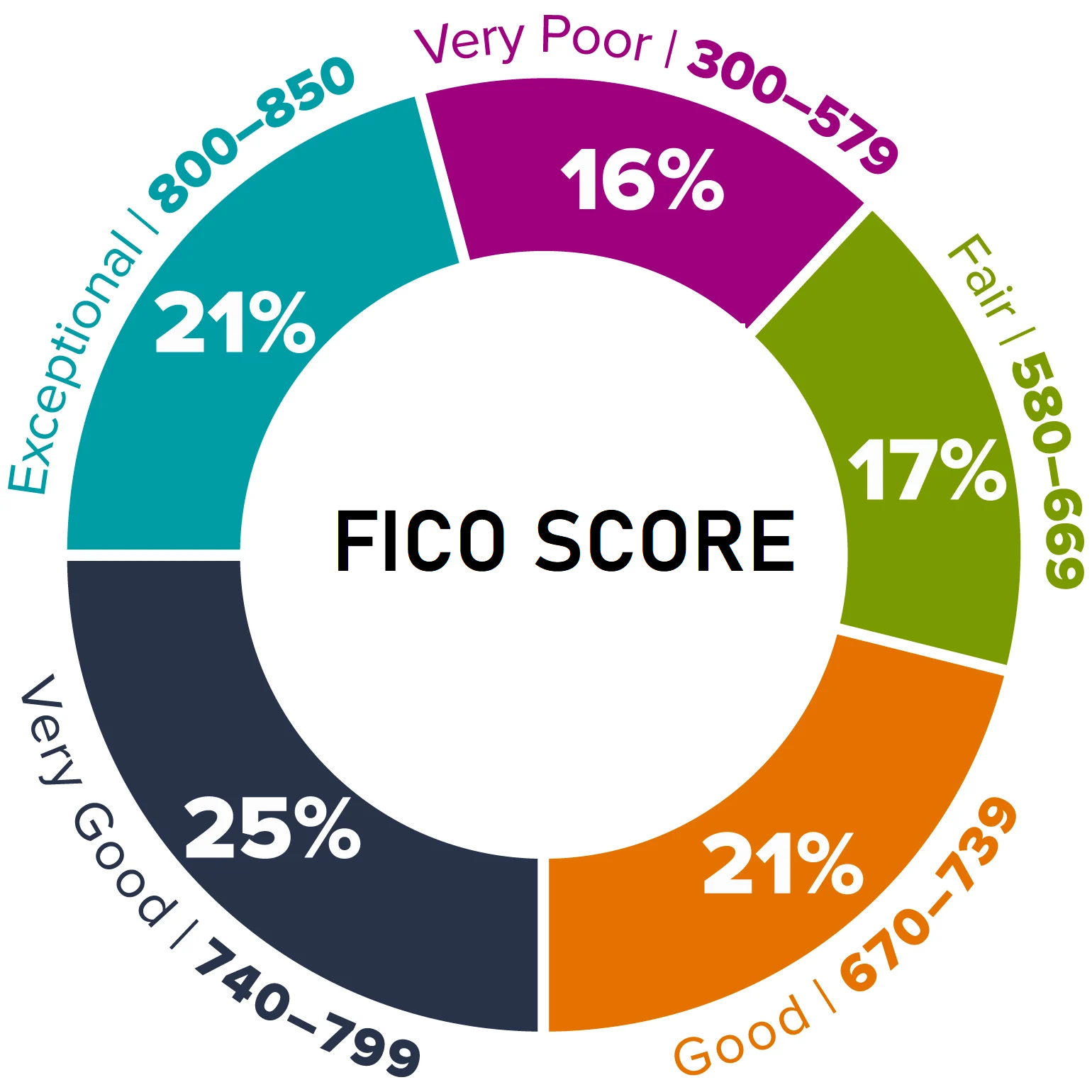

What is personal credit score?

A credit score assesses an individual’s reliability in managing and repaying debts. This score reflects the individual's credit history, including factors such as the total number and type of loans, bill payment history, total current debt, and length of credit use. Banks and lenderscommonly use credit scores to determine the risk level and eligibility for lending.

- A high credit score indicates that the individual is responsible in managing debt and regularly makes timely payments.

- This can open opportunities for loans with lower interest rates and more favorable financial conditions.

- Conversely, a low credit score can increase borrowing costs and make it more difficult to obtain loan approval.

The Importance of Credit Score

In many countries, credit scores play a central role in the global financial system as they are a measure of an individual’s financial trustworthiness. Credit accessibility, loan terms, and even basic services like renting a home or securing a mobile phone contract are influenced by this score. Credit scores not only help lenders assess lending risk but also directly impact the interest rates an individual may face. A higher credit score often leads to lower loan interest rates, which saves money and improves financial accessibility.

- A credit score can affect other important aspects of life, including insurance premiums and job opportunities. In many industries, especially finance, a good score not only reflects sound financial management but can also open up new career prospects.

- A credit score is an essential tool for ensuring transparency in the financial system, reducing risk for both lenders and borrowers.

- On a global scale, credit scores are indispensable in building and maintaining a stable and transparent financial system, contributing to economic development and improving the quality of life.

- Every country, from developed economies to emerging markets, recognizes the value of an efficient credit system, with personal credit scores as a core component.

Solution to Access Credit Scores

Registering for a free account at New World CIC provides individuals with the opportunity to monitor their credit score at no cost. Users can receive monthly credit score updates, compare financial products like credit cards and mortgage loans, and even improve their score immediately by connecting their bank accounts.

This feature helps individuals understand their financial standing, make informed financial decisions, and optimize access to credit services.

Tips to Improve Credit Scores

To enhance a credit score, individuals can follow these tips:

- Pay on time: Maintain timely payments on debts, including credit cards, bills, and loans. On-time payment history is the most critical factor in building and maintaining a high credit score.

- Reduce outstanding balances: Lower the total debt on credit cards and other loans. Keeping credit usage below 30% of the total credit limit is recommended for improving credit scores.

- Keep old credit accounts open: A long credit history positively impacts the credit score. Keeping old accounts open, even if unused, can help extend the individual's credit history.

- Limit new credit inquiries: Each new credit inquiry can temporarily lower the score. Limiting the number of credit inquiries, especially over a short period, can prevent negative effects on the score.

- Diversify credit accounts: Having a mix of credit accounts, such as credit cards, mortgages, and personal loans, demonstrates the ability to manage various types of debt and can improve the credit score.

- Regularly check credit reports: Periodically review credit reports to detect and correct any errors. Correcting reporting errors can quickly improve credit scores.

- By following these tips, individuals can improve their credit scores, opening up more financial opportunities with lenders.

Factors Beyond Credit Scores Considered by Lenders

When evaluating loan applications, lenders consider more than just credit scores. They also examine other factors to assess the individual’s overall financial capacity.

Income and employment stability are critical factors, as they indicate financial stability and repayment ability. Individuals with stable incomes and long-term employment are often viewed more favorably.

- Credit history also plays an important role, reflecting the individual’s past financial behavior, including payment history and any unpaid debt. Current debt levels, particularly outstanding credit card balances and other loans, are closely scrutinized.

- Another important factor is the debt-to-income ratio, which shows the balance between income and monthly debt payments. The lower the ratio, the higher the chances of loan approval.

- Lenders also consider the purpose of the loan, with loans for housing or education typically viewed more favorably than consumer loans. The individual’s assets and savings demonstrate financial capacity, reducing the lender’s risk.

- Finally, a positive prior relationship with the lending institution can increase the likelihood of loan approval.