- Personal Credit Score

- Personal Credit Report

- Identity Verification

What is credit report?

A credit report is an essential document that provides a detailed account of an individual's financial history and debt repayment capabilities through an analysis of loans and credit card usage. This report includes basic personal information such as name, address, and date of birth.

Additionally, it provides a comprehensive listing of credit accounts, including credit cards, home loans, auto loans, and other personal loans, alongside their current status, outstanding balances, and payment history.

- Recent credit inquiries, significant financial issues such as bankruptcy, overdue taxes, and foreclosed mortgages are also reflected in the report.

- Moreover, credit disputes and previous errors are recorded, helping individuals better understand their current financial standing.

- This report not only assists lenders in evaluating risk when granting credit but also helps individuals become more aware of how their financial behavior influences their creditworthiness.

The Importance of a Credit Report

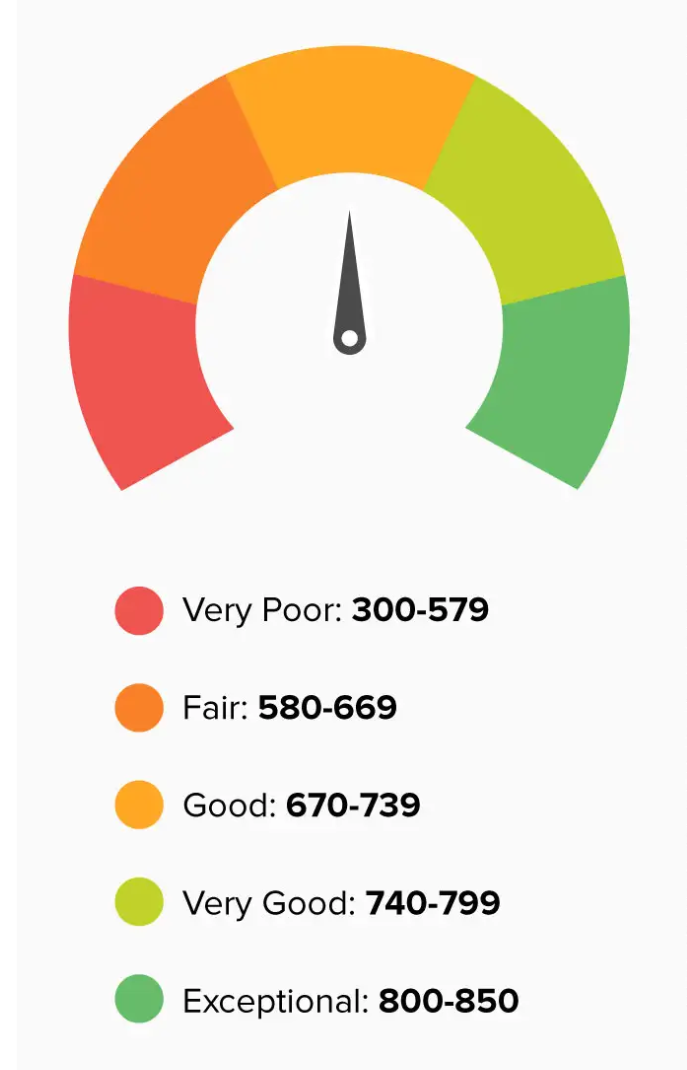

A personal credit report serves as a 'financial transcript' for individuals, influencing many aspects of economic life. It is a tool used by banks and lendersto assess an individual’s ability to repay debts. The credit score and financial history contained in the report determine whether an individual qualifies for loans and credit cards.

- A high credit score, as reflected in a positive credit report, typically results in lower interest rates on loans, thereby reducing financial burdens. On the other hand, a low credit score may lead to higher interest rates, increasing borrowing costs.

- Furthermore, credit reports are crucial in rental agreements and service contracts, where landlords and service providers often assess an individual’s reliability in paying bills.

- In some industries such as finance, insurance, and real estate, credit scores can even impact career opportunities.

- Insurance companies also use credit report information to determine insurance premiums, under the assumption that individuals with higher credit scores present lower risks.

- Lastly, regular credit report checks help individuals monitor for fraud or identity theft, ensuring long-term financial stability and growth.

New World CIC’s Enhanced Solution

New World CIC offers an enhanced solution that provides individuals with access to personal credit reports and advanced features. Through this account, individuals can receive daily credit score updates, providing insight into how lendersassess their financial capabilities.

Weekly credit score alerts and daily access to credit reports offer a thorough understanding of credit history over the past five years, aiding in loan decisions made by credit institutions.

- This solution allows users to track credit score history, review factors affecting their scores, and receive personalized suggestions for improvement. The credit score simulator enables individuals to predict how new credit applications may impact their scores and the time required for score recovery.

- Fraud protection services and web monitoring safeguard personal data, with immediate notifications via email, SMS, or app alerts when changes occur in the credit report.

- The credit report lock feature prevents fraudulent credit applications under the individual’s name and sends alerts when the credit profile is accessed or locked.

- New World CIC’s professional customer support team in Vietnam is always available to discuss credit reports and scores, ensuring an optimal customer experience.

The Impact of Credit Report Errors on Loan Applications

Errors in a credit report can negatively affect a loan application. First, inaccurate information, such as mistakenly recorded late payments, can lead to loan rejection. Second, credit scores affected by errors may result in higher interest rates imposed by lenders, increasing borrowing costs.

- Moreover, errors in the report can delay the loan approval process as additional time is needed to verify information. This not only causes delays but also requires the borrower to spend time disputing and correcting the inaccuracies. If not promptly addressed, errors in payment history could lead lenders to view the borrower as a higher risk than they actually are.

- To ensure smooth loan applications, individuals should regularly review their credit reports and promptly correct any errors. This helps avoid unnecessary obstacles and improves access to better loan terms.

Reasons for Loan Application Rejections

Several factors can lead to a loan application being rejected, and understanding these reasons can help individuals improve their chances of approval in the future.

- One common reason is a weak credit history. Lenders need to see evidence of past debt repayment, and if an individual has no credit history or has recently moved to a new country, insufficient data may lead to rejection.

- The inability to verify identity and address is another important factor. If address information is not updated, lenders may struggle to confirm identity.

- Mistakes in the loan application, such as incorrect address entries, can increase the risk of rejection

- Submitting multiple credit applications within a short period is often seen as a sign of financial instability, raising concerns for lenders.

- Negative credit history, such as late payments, unpaid debts, or court judgments, also contributes to rejection.

- Additionally, financial links with individuals with poor credit, such as joint accounts, can reduce the likelihood of approval.

- The specific criteria of the lending institution, such as income requirements, job stability, or targeting specific customer segments, can also influence the decision. The best way to understand why an application was rejected is to contact the lender directly and review the credit report to ensure all information is accurate.

Tips to Increase Loan Approval Chances

To improve the chances of loan approval and secure favorable loan terms, individuals should understand the criteria of lenders and optimize their credit profiles. Here are some effective strategies:

- Limit new credit applications: Submitting too many credit applications within a short period can raise concerns about financial stability. Individuals should apply for credit no more than once every three months to minimize negative impacts.

- Update personal and address information: Ensure residential information is accurate and up to date. Registering to vote or verifying addresses helps lenders easily confirm identity.

- Regularly review and update credit reports: Individuals should frequently monitor their credit reports to identify and correct errors, thereby improving their credit scores.

- Track credit scores: Regularly checking credit scores helps individuals better understand their financial situation and monitor credit improvement progress.

- Build credit history with small loans: Starting with small loans and ensuring timely payments helps individuals establish credibility with lenders and demonstrate financial management skills.

- Compare credit products: Researching and comparing suitable credit products, such as mortgages, personal loans, or credit cards, helps individuals choose financial products that match their capabilities.

- By implementing these strategies, individuals can increase their chances of credit approval and secure better loan terms. New World CIC is committed to supporting individuals in managing and improving their credit profiles effectively.